While there is a limited upside, sellers of options should be cautioned that there is a greater downside loss because you could lose than more than 100% of your original capital invested.

Writing options to generate higher returns comes with a large amount of risk and “collecting an immediate payoff is not as easy as it sounds

Options writers are often compared to the house of a casino,” Ma said. “It only makes sense if you have the large cashflow to pay out in the short run. Remember, in the long run, the house always wins.

Shorting the indexes is one strategy to profit from increased volatility, but most investors are not comfortable doing because of the increase in risk, said Meredith Zidek, a Hunt Valley, Md.-based options and ETF trader.

Read more

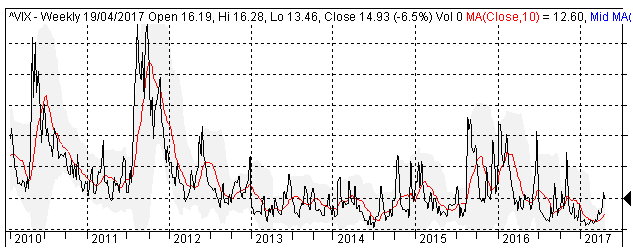

The chart below shows the VIX index from 2010 to the present.

As we can observe from the chart, the VIX has exhibited several sharp spikes following relatively quiet periods. This means that selling naked puts and not managing them correctly is indeed a risky business.

On the research side, a recent paper entitled Forecasting a Volatility Tsunami by A. Thrasher presented several studies on the volatility spikes. It also provides a method for predicting those spikes. Although we still haven’t had any opinion yet on the merits of this prediction method, we think the paper is worth a read

The empirical aim of this paper is motivated by the anecdotal belief among the professional and non-professional investment community, that a “low” reading in the CBOE Volatility Index (VIX) or large decline alone are ample reasons to believe that volatility will spike in the near future. While the Volatility Index can be a useful tool for investors and traders, it is often misinterpreted and poorly used. This paper will demonstrate that the dispersion of the Volatility Index acts as a better predictor of its future VIX spikes.

No comments:

Post a Comment