Investors have the option to invest in various assets. Among these, the most well-known are bonds and stocks. The reason behind their popularity is the balance between the risks and rewards they provide to investors. However, both are different from each other in their characteristics and the markets or brokers that contribute to them.

What is a Bond Market?

A bond market is also known as the credit or debt market. It refers to the market in which investors trade debt instruments, most prominently bonds, often issued by companies or governments. When investing in these instruments, investors take the role of a lender. They provide a loan to the issuer of the bond in exchange for subsequent interest and principal payments.

The most prominent advantage of investing in the bond market for investors is that it provides a steady income source. In comparison to stock investments, the income from bonds may be lower. However, it also comes with lower risks for the investor. For government-issued bonds, such as Treasury bonds, the risks may be minimal.

There are various reasons why investors prefer to include bonds in their portfolios. Most prominently, bonds allow them to diversify their portfolio. Similarly, investors prefer bonds in uncertain times, as it provides them with a fixed income with lower risks. Usually, risk-averse investors favour bond investments over other types of investments.

Unlike most stock markets, bond markets don’t have a centralized location. Therefore, investors usually get bonds through a broker-dealer network. Most bond markets don’t have individual investors either. They include larger institutional investors instead. Some of these investors then further trade with individual investors.

What is the Stock Market?

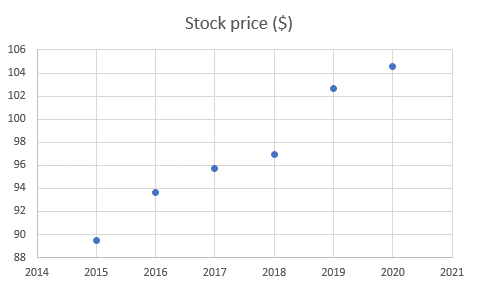

A stock market is a market in which investors trade equity instruments, usually stocks. However, it may also include options and futures. By investing in the stock market, investors can buy shares for the ownership of corporations. As opposed to bond investments, stock investments may provide much higher returns, although they may come with higher risks.

Stock markets are usually centralized locations that bring buyers and sellers together. They provide a regulated and controlled environment where investors can trade with each other or with companies. The transactions involved in the stock market are relatively more transparent and fairer. Therefore, it provides all investors with similar conditions in which they can trade.

The reason why investors prefer to include stocks in their portfolios is that they provide better returns. Investors can not only benefit from steady dividend payments but also take advantage of capital gains. Similarly, stocks have a higher chance of increasing wealth to the holders compared to a bond's fixed-income returns.

What are the differences between a Bond and Stock Market?

As mentioned, the primary difference between the two types of markets is their location. While bond markets are decentralized, stock markets have a centralized location. Similarly, both vary due to the risks involved in investing in their underlying instruments. Likewise, the rewards that investors get from each type of instrument in these markets also differ.

Conclusion

Bond markets are locations where investors can trade debt instruments. On the other hand, stock markets are for equity investments. Investors can use both markets to create a diversified portfolio. However, there are some differences between the markets and their underlying instruments, as discussed above.

Originally Published Here: Bond Market vs Stock Market