A few weeks ago, we reported that problems started emerging in the car loan sector

Will Subprime Car Loan be the Next Big Short?

This week, Rupert Hargreaves of Valuewalk pointed out that the defaults in the auto sector started to spread out to other areas of the market:

“Will rising consumer default rates spread from autos to other loans? Yes. We are already seeing evidence that subprime personal unsecured and credit card delinquency rates are rising from low levels in recent vintages, and bank loan officer surveys validate this thesis. Further, poor performance in auto loans is increasingly emerging not only in subprime but also non-prime (and some prime) loans.” Read more

Likewise, on the corporate credit market side, Bob Stokes recently wrote that European credit spreads are widening, meaning that investors have become more fearful:

Many European bond investors are not so confident about the future.

Yield spreads between investment grade bonds and lower quality debt has been widening. This means investors in the shakier debt perceive a greater risk of defaults, so they’re demanding a higher yield for assuming that risk.

The bond market is behaving much as it did before previous credit crises in 2008, 2010 and 2012. … On February 7, French 10-year notes sank to an 18-month low, sending French spreads over German debt (top chart) to their widest level since early 2014. Dutch and Italian spreads (middle and lower chart) have likewise widened, recently touching respective three-year highs. Read more

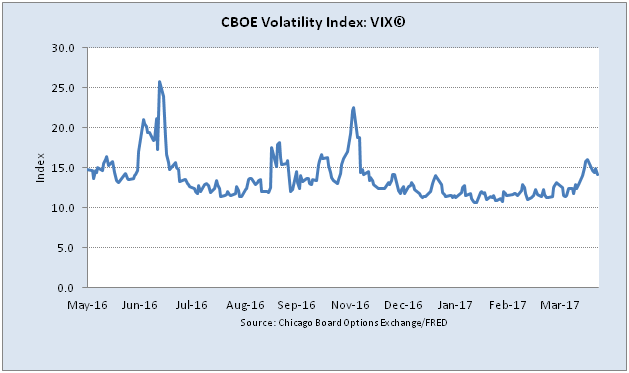

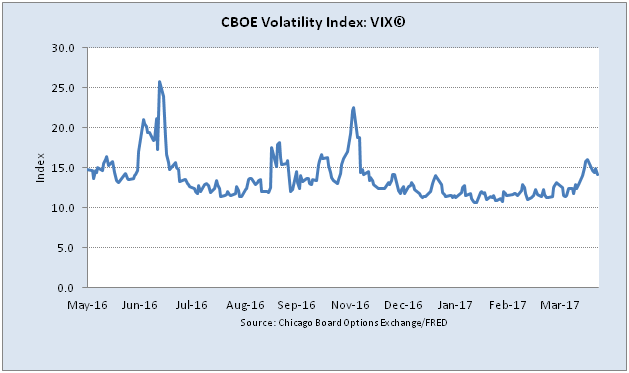

However, despite these warning signs, the equity volatility still remains relatively low. In fact, Nicholas Spiro wrote

The ability of markets to climb a “wall of worry” and turn a blind eye to the plethora of vulnerabilities facing the global economy – from the rapid build-up of corporate debt in China to the dangers in exiting ultra-loose monetary policies, particularly in Europe and Japan – seems to know no bounds. This makes it nigh impossible for economists and investment strategists to predict with any degree of certainty the catalysts and precise timing of the next major financial crisis

He also pointed out a reason for the subdued volatility

International investors – initially speculative ones such as hedge funds, but more recently long-term institutional investors – have been placing big bets on volatility remaining subdued for the foreseeable future. These bets, known as “shorting”, or selling, volatility in Wall Street parlance, have proven extremely profitable and are suppressing volatility further.

Yet the more subdued the volatility, the greater the distortion in asset prices and, once financial turmoil finally erupts, the bigger the scope for a much more disorderly sell-off than would otherwise be the case if investors had not been selling volatility over the past several years.

What is clear is that the Vix has become a poor gauge of investors’ sensitivity to the vulnerabilities and threats in the global economy that could precipitate the next crisis. Read more

So which market is right, equity or credit?

Will Subprime Car Loan be the Next Big Short?

This week, Rupert Hargreaves of Valuewalk pointed out that the defaults in the auto sector started to spread out to other areas of the market:

“Will rising consumer default rates spread from autos to other loans? Yes. We are already seeing evidence that subprime personal unsecured and credit card delinquency rates are rising from low levels in recent vintages, and bank loan officer surveys validate this thesis. Further, poor performance in auto loans is increasingly emerging not only in subprime but also non-prime (and some prime) loans.” Read more

Likewise, on the corporate credit market side, Bob Stokes recently wrote that European credit spreads are widening, meaning that investors have become more fearful:

Many European bond investors are not so confident about the future.

Yield spreads between investment grade bonds and lower quality debt has been widening. This means investors in the shakier debt perceive a greater risk of defaults, so they’re demanding a higher yield for assuming that risk.

The bond market is behaving much as it did before previous credit crises in 2008, 2010 and 2012. … On February 7, French 10-year notes sank to an 18-month low, sending French spreads over German debt (top chart) to their widest level since early 2014. Dutch and Italian spreads (middle and lower chart) have likewise widened, recently touching respective three-year highs. Read more

However, despite these warning signs, the equity volatility still remains relatively low. In fact, Nicholas Spiro wrote

The ability of markets to climb a “wall of worry” and turn a blind eye to the plethora of vulnerabilities facing the global economy – from the rapid build-up of corporate debt in China to the dangers in exiting ultra-loose monetary policies, particularly in Europe and Japan – seems to know no bounds. This makes it nigh impossible for economists and investment strategists to predict with any degree of certainty the catalysts and precise timing of the next major financial crisis

He also pointed out a reason for the subdued volatility

International investors – initially speculative ones such as hedge funds, but more recently long-term institutional investors – have been placing big bets on volatility remaining subdued for the foreseeable future. These bets, known as “shorting”, or selling, volatility in Wall Street parlance, have proven extremely profitable and are suppressing volatility further.

Yet the more subdued the volatility, the greater the distortion in asset prices and, once financial turmoil finally erupts, the bigger the scope for a much more disorderly sell-off than would otherwise be the case if investors had not been selling volatility over the past several years.

What is clear is that the Vix has become a poor gauge of investors’ sensitivity to the vulnerabilities and threats in the global economy that could precipitate the next crisis. Read more

So which market is right, equity or credit?

No comments:

Post a Comment