In finance, beta measures a stock's volatility with respect to the overall market. It is used in many areas of financial analysis and investment, for example in the calculation of the Weighted Average Cost of Capital, in the Capital Asset Pricing Model and market-neutral trading.

Beta of an investment is a measure of the risk arising from exposure to general market movements as opposed to idiosyncratic factors.

The market portfolio of all investable assets has a beta of exactly 1. A beta below 1 can indicate either an investment with lower volatility than the market, or a volatile investment whose price movements are not highly correlated with the market. An example of the first is a treasury bill: the price does not fluctuate significantly, so it has a low beta. An example of the second is gold. The price of gold fluctuates significantly, but not in the same direction or at the same time as the market.

A beta greater than 1 generally means that the asset both is volatile and tends to move up and down with the market. An example is a stock in a big technology company. Negative betas are possible for investments that tend to go down when the market goes up, and vice versa. There are few fundamental investments with consistent and significant negative betas, but some derivatives like put options can have large negative betas. Read more

In this post, we present a concrete example of calculating the beta of Facebook, a technology stock. As for the market benchmark, we utilize SPY.

The beta of a financial instrument is calculated as follows,

![]()

where

- rS is the stock return,

- rM is the market return,

- Cov denotes the return covariance and,

- Var denotes the return variance.

We downloaded 5 years of data from Yahoo Finance and implemented equation (1) in Python. The picture below shows the result returned by the Python program

![]()

It’s observed that the beta of Facebook is 1.19, which means that Facebook is more volatile than the market.

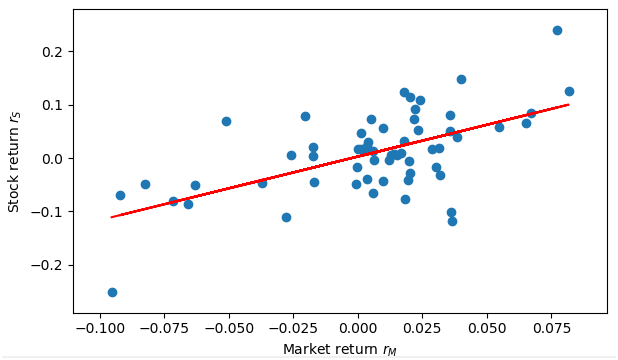

The next picture shows the stock returns regressed against market returns. Note that the slope of the linear regression line equals the beta of the stock.

Follow the link below to download the Python program.

Article Source Here: What is Stock Beta and How to Calculate Stock Beta in Python

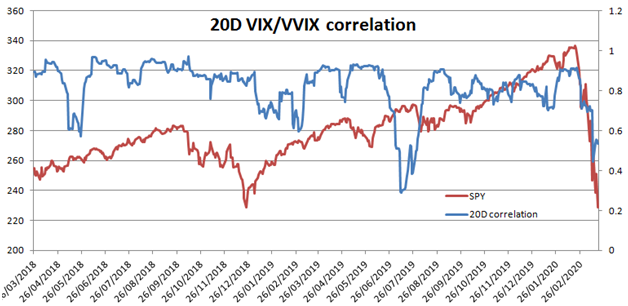

Correlation between the VVIX and VIX indices[/caption]

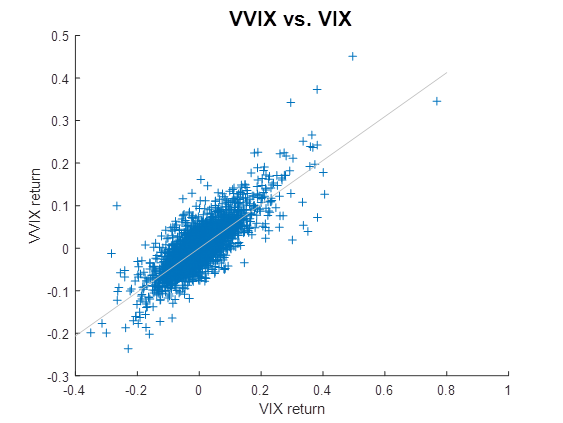

Correlation between the VVIX and VIX indices[/caption] VVIX returns vs. VIX returns[/caption]

VVIX returns vs. VIX returns[/caption]