The Tail Value at Risk (TVaR) is a financial measure of a potential loss in a portfolio. Tail Value at risk uses the same statistical principles as the traditional value at risk with the only difference being that it measures an expectation of the remaining potential loss given a probability level has occurred.

Conceptually, tail value at risk is similar to Value-at-Risk (VaR), except it measures the maximum amount of loss that is anticipated with an investment portfolio over a specified period, with a degree of confidence

In this article, we'll first look at the basic theory behind the value at risk, and then we will introduce tail value at risk.

What is the Standard Deviation

Value at Risk is the measure of the downside or risky part of an investment. To be more precise, it answers this question: "What is the potential loss in a portfolio?".

To understand how Value at Risk works, we should first understand what a standard deviation is.

The standard deviation is one of the most commonly used tools for measuring variability and dispersion of data. If you are not familiar with the concept of standard deviation, you may want to check out "Standard Deviation and Variance: Statistics for Stock Traders" first.

Standard deviation can be used to measure both upside and downside variability in a portfolio. In order to get a better grip on this idea, let's look at a simple example below:

Suppose that you have a well-diversified portfolio, which you are tracking on daily basis. For the sake of simplicity, let's assume that this portfolio has 10 securities in it.

Daily returns are normally distributed with an average return of 0% and a standard deviation of 2%. So, one day you noticed that your overall return is -4%, instead of 0%. This is definitely not good news.

You have a look at the largest losses for each of the 10 securities and you notice that some of them are making significant contributions to your loss. Next, you looked into historical data and noticed that the securities that made a negative contribution to your portfolio on that day also did so in 50% of all cases. In other words, they have a downside correlation of 50%.

In order to assess the risk inherent in the portfolio going forward, you want to calculate how much money you may lose going forward.

So now let's find out how to calculate Value at Risk of a portfolio.

Calculating Value at Risk

Here is how you calculate value at risk

Value at Risk = [Expected Weighted Return of the Portfolio− (z-score of the confidence interval× standard deviation of the portfolio)] × portfolio value

The standard deviation in portfolio returns is usually smaller than the individual securities' standard deviation since diversification helps to reduce dispersion. Also, you can expect that there will be more negative values than positive values in your tail distribution. This is because in reality the return distribution is not normally distributed (left-skewed).

Calculating Tail Value at Risk

Now, let’s examine what Tail Value at Risk is,

There are a number of related, but subtly different, formulations for TVaR in the literature. A common case in literature is to define TVaR and average value at risk as the same measure. Under some formulations, it is only equivalent to expected shortfall when the underlying distribution function is continuous at VaR(X) the value at risk of level alpha. Under some other settings, TVaR is the conditional expectation of loss above a given value, whereas the expected shortfall is the product of this value with the probability of it occurring.The former definition may not be a coherent risk measure in general, however it is coherent if the underlying distribution is continuous. The latter definition is a coherent risk measure. TVaR accounts for the severity of the failure, not only the chance of failure. The TVaR is a measure of the expectation only in the tail of the distribution. Read more

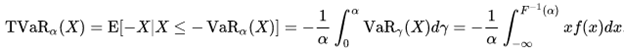

If X is the payoff of a portfolio that has f as the probability density function and F as the cumulative distribution function, then the left Tail Value at Risk can be expressed as follows,

Conclusion

As you can see Tail Value at Risk is very useful when it comes to measuring the downside risks of your portfolio. Although this method does have its limitations, it is definitely a step in the right direction.

Originally Published Here: Tail Value at Risk: Formula, Definition

No comments:

Post a Comment