Time series analysis is an important subject in finance. In this post, we are going to apply a time series technique to a financial time series and develop an investment strategy. Specifically, we are going to use moving averages to trade volatility Exchange Traded Notes (ETN).

Moving averages are used on financial time series data to smooth out short-term noises and identify longer-term trends. We apply them to VXX, a volatility ETN. Note that VXX

- Launched in 2009

- Enables investors to bet on the size of swings in the S&P 500 Index (SPX)

- Used by individual investors and hedge fund managers alike

- Peaked at $2 billion under management in Feb. 2018, now $800 million

- Structured as a debt instrument with a maturity date of Jan. 30, 2019

- Was replaced by the VXXB, which has other features. Read more

The trading rules are as follows [1],

If 10-day Moving Average (MA10) < 30-day Moving Average (MA30) Sell Short

If 10-day Moving Average (MA10) >= 30-day Moving Average (MA30) Cover Short

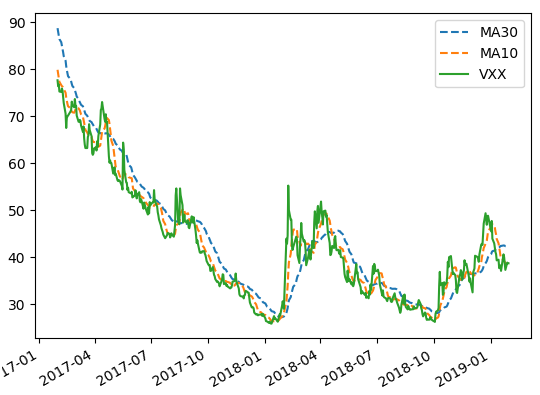

The system is implemented in Python. Graph below shows the MAs and VXX for the last 2 years.

[caption id="attachment_654" align="aligncenter" width="540"] VXX and Moving Averages[/caption]

VXX and Moving Averages[/caption]

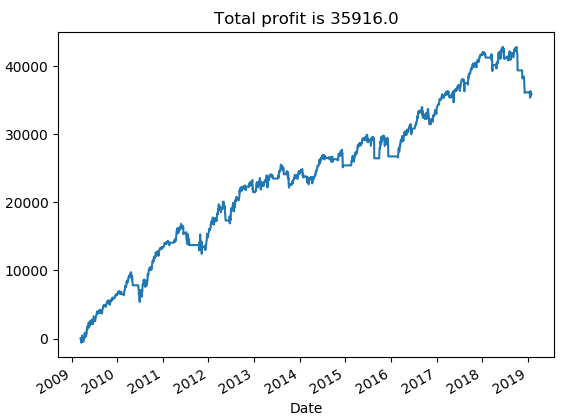

The position size is $10000; leverage is not utilized, and profit is not compounded. Graph below shows the equity curve for the trading strategy from January 2009 to January 2019.

[caption id="attachment_655" align="aligncenter" width="564"] Equity curve for VXX trading system[/caption]

Equity curve for VXX trading system[/caption]

Click on the link below to download the Python program and data file.

References

[1] L. Connors, Buy the Fear, Sell the Greed: 7 Behavioral Quant Strategies for Traders, TradingMarkets Publishing, 2018

Post Source Here: A Volatility Trading System-Time Series Analysis in Python

No comments:

Post a Comment