Debt instruments are an important part of the capital market. In this post, we are going to provide an example of pricing a fixed-rate bond.

A fixed rate bond is a long term debt paper that carries a predetermined interest rate. The interest rate is known as coupon rate and interest is payable at specified dates before bond maturity. Due to the fixed coupon, the market value of a fixed-rate bond is susceptible to fluctuations in interest rates, and therefore has a significant amount of interest rate risk. That being said, the fixed-rate bond, although a conservative investment, is highly susceptible to a loss in value due to inflation. The fixed-rate bond’s long maturity schedule and predetermined coupon rate offers an investor a solidified return, while leaving the individual exposed to a rise in the consumer price index and overall decrease in their purchasing power.

The coupon rate attached to the fixed-rate bond is payable at specified dates before the bond reaches maturity; the coupon rate and the fixed-payments are delivered periodically to the investor at a percentage rate of the bond’s face value. Due to a fixed-rate bond’s lengthy maturity date, these payments are typically small and as stated before are not tied into interest rates. Read more

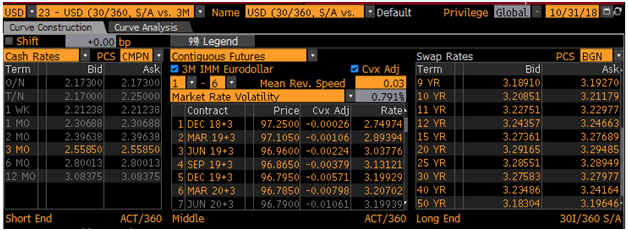

We are going to price a hypothetical bond as at October 31, 2018. We first build a zero coupon curve. Picture below shows the market rates as at the valuation date.

[caption id="attachment_595" align="aligncenter" width="628"] US swap curve as at Oct 31 2018[/caption]

US swap curve as at Oct 31 2018[/caption]

We utilize the deposit rates (leftmost column) to construct the zero curve up to 12-month maturity. We then use this zero curve to price the following hypothetical fixed rate bond:

Currency: USD

Maturity: 1 year

Payment frequency: semi-annual

Coupon rate: 3%

We use Python [1] to build a bond pricer. Picture below shows the result returned by the Python program. The price is $99.94 (per $100 notional).

![]()

Click on the link below to download the python code.

References

[1] Quantlib Python Cookbook, Balaraman and Ballabio, Leanpub, 2017

Article Source Here: Valuing a Fixed Rate Bond-Derivative Pricing in Python

No comments:

Post a Comment