Within the Merton model, equity of a firm is considered a call option on its asset, and it is expressed as follows,

V is the firm’s asset,

is the asset volatility,

is the asset volatility,r is the risk-free interest rate, and

We note that both asset (V) and its volatility

are not observable. However, the asset volatility can be related to equity and its volatility through the following equation,

are not observable. However, the asset volatility can be related to equity and its volatility through the following equation, denotes the volatility of equity.

denotes the volatility of equity. which are then used to determine the credit spread

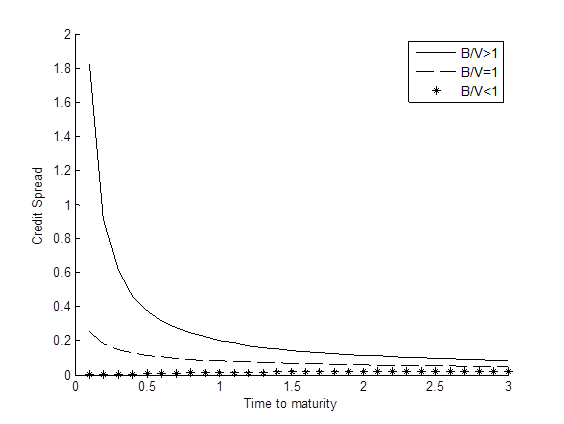

which are then used to determine the credit spreadGraph below shows the term structures of credit spread under various scenarios for the leverage ratio (B/V).

[caption id="attachment_541" align="aligncenter" width="564"]

Term structure of credit spread[/caption]

Term structure of credit spread[/caption]It’s worth mentioning that the Merton model usually underestimates credit spreads. This is due to several factors such as the volatility risk premium, firm’s idiosyncratic risks and the assumptions embedded in the Merton model. This phenomenon is called the credit spread puzzle. Research is being conducted actively in order to improve the model.

References

[1] Merton, R. C. 1974, On the Pricing of Corporate Debt: The Risk Structure of Interest Rates, Journal of Finance, Vol. 29, pp. 449–470.

Originally Published Here: Credit Risk Management Using Merton Model

No comments:

Post a Comment