In a previous post, we provided an example of pricing American options using an analytical approximation. Such a pricing model is fast and accurate enough for risk management purposes. However, sometimes more accurate results are required. For this purpose, the binomial (lattice) model can be used. Wikipedia describes the binomial tree model as follows,

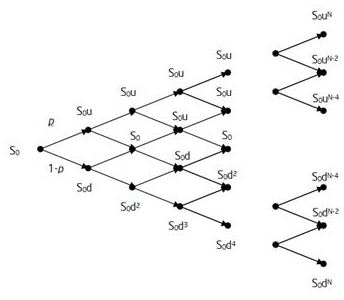

In finance, the binomial options pricing model (BOPM) provides a generalizable numerical method for the valuation of options. The binomial model was first proposed by Cox, Ross and Rubinstein in 1979. Essentially, the model uses a "discrete-time" (lattice based) model of the varying price over time of the underlying financial instrument...

The binomial pricing model traces the evolution of the option's key underlying variables in discrete-time. This is done by means of a binomial lattice (tree), for a number of time steps between the valuation and expiration dates. Each node in the lattice represents a possible price of the underlying at a given point in time.

Valuation is performed iteratively, starting at each of the final nodes (those that may be reached at the time of expiration), and then working backwards through the tree towards the first node (valuation date). The value computed at each stage is the value of the option at that point in time.

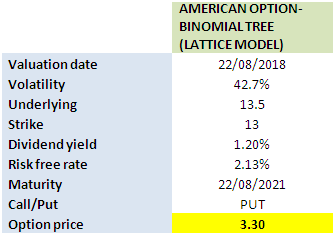

We utilized the lattice model previously to price convertible bonds. In this post, we’re going to use it to value an American equity option. We use the same input parameters as in the previous example. Using our Excel workbook, we obtain a price of $3.30, which is smaller than the price determined by the analytical approximation (Barone-Andesi-Whaley) approach.

[caption id="attachment_561" align="aligncenter" width="335"] American option valuation in Excel using Binomial Tree[/caption]

American option valuation in Excel using Binomial Tree[/caption]

Click on the link below to download the Excel Workbook.

Originally Published Here: Valuing an American Option Using Binomial Tree-Derivative Pricing in Excel

is the asset volatility,

is the asset volatility,

are not observable. However, the asset volatility can be related to equity and its volatility through the following equation,

are not observable. However, the asset volatility can be related to equity and its volatility through the following equation, denotes the volatility of equity.

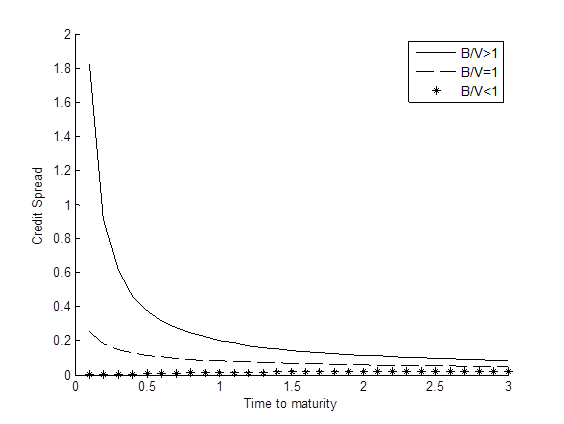

denotes the volatility of equity. which are then used to determine the credit spread

which are then used to determine the credit spread Term structure of credit spread[/caption]

Term structure of credit spread[/caption]