The formulation of a volatility index, and financial instruments based on such an index, were developed by Menachem Brenner and Dan Galai in 1986 and described in academic papers.The authors stated the “volatility index, to be named Sigma Index, would be updated frequently and used as the underlying asset for futures and options. … A volatility index would play the same role as the market index play for options and futures on the index.”

In 1986, Brenner and Galai proposed to the American Stock Exchange the creation of a series of volatility indices, beginning with an index on stock market volatility, and moving to interest rate and foreign exchange rate volatility. In 1987, Brenner and Galai met with Joseph Levine and Deborah Clayworth at the Chicago Board of Options Exchange to propose various structures for a tradeable index on volatility; those discussions continued until 1991.

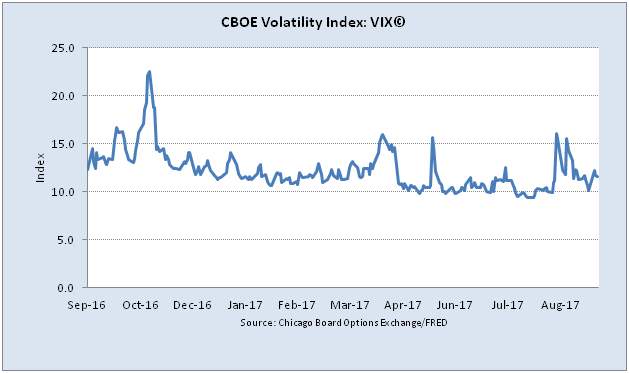

The current VIX concept formulates a theoretical expectation of stock market volatility in the near future. The current VIX index value quotes the expected annualized change in the S&P 500 index over the next 30 days, as computed from the options-based theory and current options-market data.

The CBOE retained consultant Robert Whaley in 1992 to develop a tradable volatility instrument based on index option prices. Since 1993, CBOE has published VIX real-time data. Based on historical index option prices, Whaley has computed a data series of retrospective daily VIX levels from January 1986 onward. Read more

He recently gave an interview to Business Insider. Here are the key takeaways

- It’s hard to say the market is biased one way or another. The VIX is actually reflecting market expectations in the sense that people pay for the options, it’s traded, and anybody can be on any side of the fence. It’s doing its job of reflecting the market consensus going forward.

- The market always has its own dynamics, and the effect is marginal. I don’t think they change the market. Volatility is low, and it’s been low. If the market was expected to change abruptly, we’d see it in options prices.

- When interest rates start moving up, so will volatility.

- There’s no doubt that passive investment and ETFs changed the nature of correlations in the marketplace among different securities. Once you create baskets, you create artificially high correlations between the members of those baskets. Whether it changes the environment in the long term, he’s not sure. We don’t have enough history to make any strong conclusions about it.

- You can find what’s happening in the US on a global basis. You have the same phenomenon of low volatility. Maybe the US is the dominant force, but it’s happening everywhere.

ByMarketNews

No comments:

Post a Comment