So what exactly happened?

|

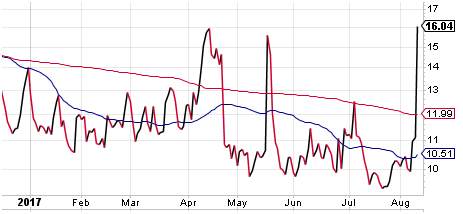

| VIX as at Aug 10, 2017. Source:stockcharts.com |

Business Insider reported,

Geopolitical anxiety has picked up in recent days amid ongoing elevated tensions between the United States and North Korea.

But even though incendiary comments from both US President Donald Trump and North Korea have spooked investors (and everybody else), markets haven’t seen a huge drop.

South Korea’s markets have seen most of the action, with the won trickling down and the benchmark Kospi stock index falling by a “minor” 1.5% this week. Meanwhile, traditionally safe-haven trades like the US dollar, the yen, and gold have picked up a bit, but not significantly. Read more

We agree that the equity indices did not decline too much. But why did the volatility go up disproportionately?

Recall that we said before:

True Volatility Is Created by What is Not Anticipated

But what really is of concern is the risk that is not anticipated. Here Jackson and Vig rely on a volatility trader’s traditional mantra: true volatility is created by what is not anticipated. What the report titled the “unknown unknowns,” a borrowing on former US Defense Secretary Donald Rumsfeld’s famous quote.

However, the tension with North Korea was somewhat anticipated. It was listed as one of the black swans

Kim Jung Un has been shooting off missiles in North Korea without consequence. Given that the North Korean regime appears irrational, who know what could happen. What if they “tried to take out our satellites?

So maybe it was due to the short interest and increased leverage?

ByMarketNews

No comments:

Post a Comment