- Slowdown in the US economy

- Debt crisis in China

- Intensifying tensions on the Korean Peninsula and in the Middle East

- Parliamentary elections in Italy with a strong showing by the Five Star Movement

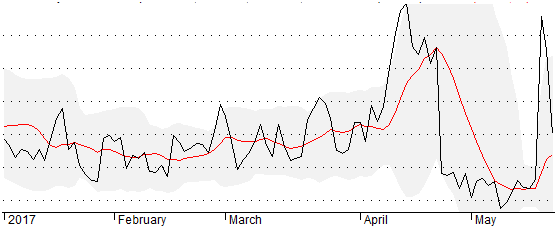

If the above uncertainties do not increase the volatility then what does? And why did the VIX index experience an outsize spike despite the fact that the underlying equity index, SP500, just went down by -1.8%?

It turned out that the political storm in Washington was the cause of the big spike in volatility. But why did it cause such a big spike?

We found an interesting quote in an article by Mark Melin on ValueWalk

But what really is of concern is the risk that is not anticipated. Here Jackson and Vig rely on a volatility trader’s traditional mantra: true volatility is created by what is not anticipated. What the report titled the “unknown unknowns,” a borrowing on former US Defense Secretary Donald Rumsfeld’s famous quote. Read more

So the political event in Washington was an unknown unknown, i.e. an event that was not anticipated.

Probably that’s why it caused such a huge jump in the VIX?

But a more important question is: how do you manage volatility risks, especially the ones resulted from an unknown unknown?

ByMarketNews

No comments:

Post a Comment