The Financial Times first reported that Jonathan Ruffer, co-founder of a $20 billion London-based discretionary fund manager for private clients, trusts, charities and pension funds bearing his name, “has been systematically buying up derivative contracts linked to an index known as the Vix, according to four people from trading departments at banks who are familiar with the trades.” Read more

While we have no opinion on the accuracy of the information, nor we know the exact details of the hedging strategy, we think that the Fund is doing the right things because of the following reasons:

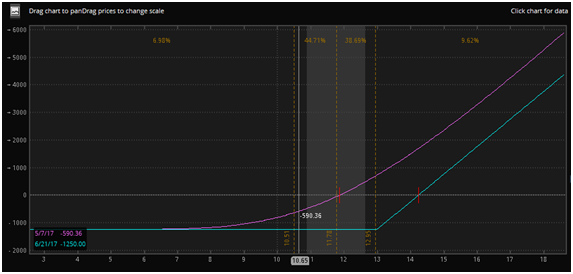

- They execute a hedging strategy, especially in this politically uncertain area. As shown in our studies, hedging comes with a cost, but it will provide a good protection for your portfolio in time of turmoil.

- They execute an explicit hedge using VIX (an index) options. Explicit hedge is necessary because hedging through portfolio diversification is not enough. Portfolio diversification relies on asset correlations that can change dramatically during a financial crisis.

- They execute a hedge that is cheaper to carry. Our research indicated that the cost of carry of long VIX calls is less than that of long SP500 puts

The VIX calls represent a small fraction of portfolio exposure, near 0.1%, but there are other hedged positions in the portfolio, including index-linked bonds and gold, according to the source.

We also think that cross-asset hedging strategies make sense.

ByMarketNews

No comments:

Post a Comment