Nobody knows the exact answer. But Gregory Meyer et al of FT.com reported that there are firms, notably DRW, based in Chicago, that already started betting on an increase in volatility this year.

Mr Wilson, DRW chief executive, says he has been surprised by the lack of volatility in financial markets since Mr Trump’s unexpected election. “There are many things that could happen that could cause volatility to increase”. Read more

D. Wilson cited political risk as the main source of uncertainty. However, beside political risk, another important source of volatility is found in the Mortgage Back Securities (MBS) market.

Even as the central bank amassed trillions of dollars of debt to prop up the economy following the financial crisis, it didn’t hedge its holdings or worry about gains and losses that might keep ordinary investors up at night. This extreme buy-and-hold stance has had an incredible calming effect on the bond market. Volatility has plummeted to lows rarely seen in recent memory. Read more

In other words, the Fed, acting as a gigantic Buy and Hold investor, has held a tremendous amount of MBS. However, they don’t hedge their positions actively, thus providing the markets with a subdue volatility.

But remember that there is an embedded option in a mortgage-backed security. It’s called the prepayment option precisely.

D’Ecclesia et al. pointed out that a prepayment option is an option to refinance a mortgage.

Mortgage-backed securities (MBS for short) combine features of both bonds and options. The investor in the MBS has purchased a fully amortizing bond, with known coupon rate and maturity date. However, at the same time the investor has written a call option to the mortgage borrower. The homowner’s privilage to refinance his or her mortgage at any point in time complicates attempts to price the MBS. Read more

Therefore the MBS holder is short a call option, i.e. he’s short convexity. Banks who originate mortgages usually use swaptions to hedge the prepayment risk.

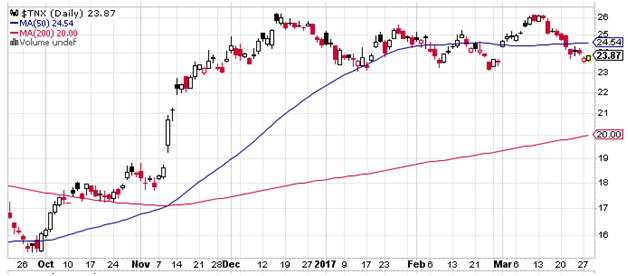

When the interest rate is low, and the biggest MBS holder is the Fed, the volatility remains low. However, when the interest rate starts to rise, the central bank’s $1.75 trillion position in mortgage-backed securities will be transferred to private investors. This means investors will be shorting embedded call options and they have to hedge. Their hedging activities will likely cause the volatility in the fixed income markets to increase. And this volatility can spill over to the equity and other markets as well.

Post Source Here: Hedging in the Mortgage Backed Securities Market Can Increase Volatilities

No comments:

Post a Comment