International Financial Reporting Standard -2 deals with the recognition, measurement, and disclosure of Employee Stock Options. In this article, we will offer examples of accounting for Employee Stock Options. At the end of this article, we will present methods for valuing Employee Stock Options.

What is an Employee Stock Option?

A company often has the policy to make its employees the shareholders; therefore they offer a certain number of shares to eligible employees as an incentive.

To retain and motivate the workforce and sometimes to comply with the regulatory requirement, the company’s management can opt to issue share options to its employees. The Employee Stock Option plan is not meant to apply to all employees, rather to those who meet certain prescribed criteria.

Employees are normally required to meet the performance as well as service criteria to be eligible for the Employee Stock Option plan. Suppose that the management imposes a service condition of five years and an employee, Mr. A, opted for this option, then after five years of service, he would become eligible to exercise his options. The company often fixes a strike price for the option holders to exercise their rights.

Eligibility of employees

It’s up to the company’s management to decide what criteria they should use when issuing Employee Stock Options, but typically it involves the fulfillment of performance obligation and service period.

Example

Company A has offered 500 share options to each of 5 managers, subject to achievement of their sales targets and continuous services of 5 years with the company. Until these conditions are not fulfilled, the company cannot book expenses for those shares in its accounting books. When the options expire, the employees can choose to settle the transaction either in equity or in cash.

Equity-settled options

In this case, the employees reserve the right to convert their share options into equity by paying only the option exercise price. The employees then become the shareholders of the company.

Cash settled options

In this case, the company offers the employees the option of selling the shares or to get cash equivalent to the market value of those shares.

From the accounting perspective, the company has to make accounting adjustments for both the equity-settled and cash-settled transactions.

How to account for the Employee Stock Options in the financial statement

At the time of offering share options, the company would need to determine the fair value of options or intrinsic value of those options. Then every year after, an expense for compensation shall be debited to employee compensation account and credit entry shall be made in outstanding balance for the compensation plan. The same pattern of entries shall be repeated until the completion of the vesting period. The vesting period is the period after which the employee would be eligible to exercise his/her right to purchase the common stock of the company.

At the end of the vesting period, the employee is offered two options: either to buy common stocks by exercising his/her options, or to get cash equivalent to the number of shares. If an employee chooses to buy shares then the balance in the outstanding account shall be debited and credit shall be made in the capital account as common stocks. If he opts for the cash option, then the outstanding account shall be debited and cash account shall be credited.

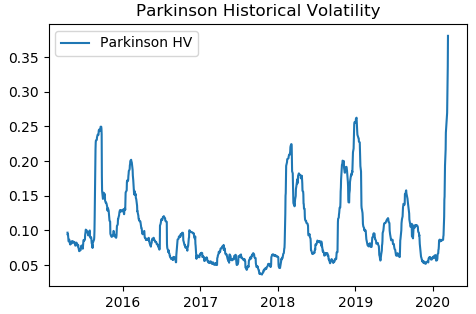

How to value Employee Stock Options

Monte Carlo and the Binomial Tree methods are the most common approaches used to price the Employee Stock Options.

Post Source Here: Accounting for Employee Stock Options, Examples and Valuation Methods