As negative interest rates started popping up around the world, quantitative analysts and traders have been asking a mundane but fundamental question: How to price trillions of dollars of financial instruments when their complex pricing models don’t work with negative numbers?

Intuitively, we would say that negative interest rates will affect the prices of interest-rate sensitive instruments such as interest rate swaps and swaptions the most. Indeed, Bloomberg recently elaborated:

The issues are most apparent in the market for interest-rate swaps. (This market allows professional investors to lock in interest rates and lets speculators bet on whether rates on bonds or loans will rise or fall.) That’s because the Black 76 model, the main tool to price options for interest-rate derivatives, and its variants are so-called log-normal forward models. For those who aren’t math nerds, it can essentially be boiled down to this: the formula breaks because it requires users to calculate a logarithm, and a logarithm of a negative number is undefined, or meaningless. Read more

As far as equity derivatives are concerned, the impact will not be as dramatic as with interest-rate sensitive instruments. However, some subtleties in the mathematical approaches can still have an impact on the accuracy of equity-derivative valuation models.

Derivatives traders in equities, on the other hand, have it relatively easy by comparison… sub-zero risk-free rates can cause “approximation errors” for certain kinds of American-style options, which may lead them to become mispriced compared with those used in Europe. Take an American call option on a stock without dividends, for example. Its value will “only equal the European option when the risk-free rate is positive”

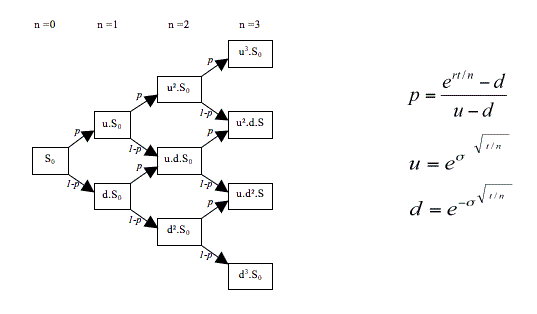

Specifically, when we price an American call option, we often argue that if the underlying stock pays no dividend, then it’s never optimal to exercise earlier, i.e. the price of an American call option is equal to its European counterpart.

To see this, recall that there exists a lower bound for an American call option on a non-dividend paying stock [1]:

![]()

where C denotes the price of an American call option

S0 is the stock price

K is the strike price

T is the time to maturity

r is the risk-free interest rate

From this equation, it follows that when r> 0, C >= S0-K. This means that the American call’s price is always greater than its intrinsic value, therefore it’s never optimal to exercise before maturity.

However, when r<=0, the above condition will no longer be true, and the American call option can be exercised earlier. This will impact the mathematical models that price American options.

References

[1] J.C. Hull, Options, Futures, and Other Derivatives, 9th Edition, 2018

Post Source Here: How Negative Interest Rates Affect Derivative Pricing Models