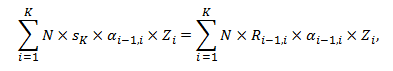

Goldman analysts Rocky Fishman and John Marshall said that the VIX, which uses options bets on the S&P 500 to reflect expected volatility over the coming 30 days, has been hovering at or below 13, marking its lowest level since around January (though it is tipping up in Monday trade). Its current level takes the gauge of implied volatility, which tends to rise when stocks fall and vice versa, well below its historic average at about 19.5 since the fear index ripped higher in February.

Goldman argues that the 5-day intraday swings of the S&P 500 have been out of whack with the price of the cost of a one-month straddle on the index. A straddle is an options bet that allows an investor to profit from a sharp move in an asset, but without wagering on the specific direction of that expected move. In other words, it is an inherent bet on volatility. A straddle can be structured by buying a put option, which confers the owner the right but not the obligation to sell an asset at a given time and price, and a call option, which offers the comparable right to buy an underlying asset, at the same expiration date and strike price. Read more

| Volatility Index VIX as of May 18 2018 |

But is the volatility index predictable? How about VIX futures and ETFs?

A recent research article raised some interesting questions,

The VIX index is not traded on the spot market. Hence, in contrast to other futures markets, the VIX futures contract and spot index are not linked by a no-arbitrage condition. We examine (a) whether predictability in the VIX index carries over to the futures market, and (b) whether there is independent time series predictability in VIX futures prices.

The answer is no.

The answer to both questions is no. Samuelson (1965) was right: VIX futures prices properly anticipate predictability in volatility, and are themselves unpredictable. Read more

But then why do we trade VIX futures and ETFs?

We think that the reasons might be:

- Trading the spot VIX is difficult,

- When trading VIX futures and ETFs, we exchange the predictability of the spot index for a little extra return stemming from the volatility risk premium.

ByMarketNews

Libor-OIS spread as at May 2, 2018. Source: Bloomberg[/caption]

Libor-OIS spread as at May 2, 2018. Source: Bloomberg[/caption]

is the daily accrual factor, and

is the daily accrual factor, and