Watch it here: New IFRS 9 Rules May Do More Harm Than Good

Thursday, March 30, 2017

New IFRS 9 Rules May Do More Harm Than Good

In a previous post, we discussed about the financial risks

under the new IFRS9 accounting rules from the risk management perspective. In this video, Al Rosen explained why he

believes the new rules are "badly conceived”.

Is There a Less Expensive Hedge Than a Protective Put ?

In this post we examine different hedging strategies using instruments

on the same underlying. Our goal is to investigate the cost,

risk/reward characteristics of each hedging strategy. Knowing the

risk/reward profiles will allow us to design a cost-effective

portfolio-protection scheme.

The hedging strategies we’re investigating are:

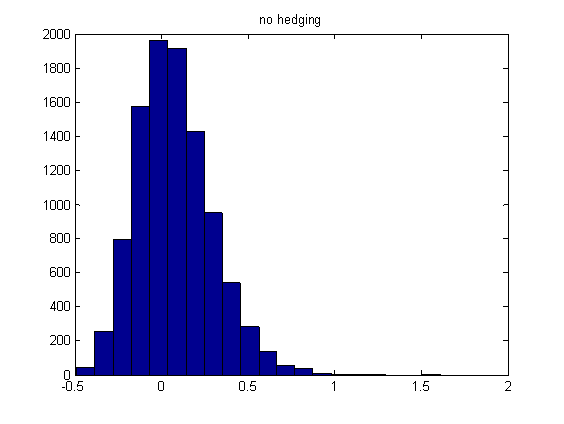

1-NO HEDGE: no hedging is performed. The asset is allowed to evolve freely in a risky world. This would correspond to the portfolio of a Buy and Hold investor.

2-PPUT: protective put. We buy an at the money (ATM) put in order to hedge the downside. This strategy is the most common type of portfolio insurance.

3-GAMMA: convexity hedge. We buy an ATM put, but we then dynamically hedge it. This means that we flatten out the delta at the end of every day.

Continue to read Is There a Less Expensive Hedge Than a Protective Put ?

The hedging strategies we’re investigating are:

1-NO HEDGE: no hedging is performed. The asset is allowed to evolve freely in a risky world. This would correspond to the portfolio of a Buy and Hold investor.

2-PPUT: protective put. We buy an at the money (ATM) put in order to hedge the downside. This strategy is the most common type of portfolio insurance.

3-GAMMA: convexity hedge. We buy an ATM put, but we then dynamically hedge it. This means that we flatten out the delta at the end of every day.

Continue to read Is There a Less Expensive Hedge Than a Protective Put ?

Wednesday, March 29, 2017

Volatility Risk Premia and Future Commodities Returns

This paper extends the empirical literature on Volatility Risk Premium (VRP) and future returns by analyzing the predictive ability of Commodities Currencies VRP and commodities VRP. The empirical evidence throughout this paper provides support for a positive relationship of Commodities Currencies VRP and future commodities returns, but only for the period after the 2008 Global Financial Crisis. This predictability survives to the inclusion of control variables like the Equity VRP and past currency returns. Furthermore, we find a negative relationship between Gold VRP and future commodities and currency returns. This result corroborates the view of Gold as a safe haven asset.

Continue to read:

http://www.bis.org/publ/work619.pdf

Continue to read:

http://www.bis.org/publ/work619.pdf

Sunday, March 26, 2017

Will IFRS 9 Help Commodity Firms Better Manage Risks?

Less than a year from now, the banks will have to introduce the IFRS 9 Impairment, and it will have a substantial financial impact on them. However, it is not just banks that will be affected by this new accounting standard, non-financial corporations, for example commodity firms, will be impacted as well.

The Treasurers Wiki explains the benefits of moving from IAS 39 to IFRS 9 for commodity firms:

Under IAS 39, a non-financial item may be designated as a hedged item in its entirety (i.e. all risks), for foreign exchange (FX) risks or for all risks except FX risk. As a result, if an entity economically hedges a non-financial item for a risk component other than FX risk, it is not permitted to designate a hedge for that component in isolation. For example, an entity could not hedge only the inflation component of an operating lease where the contractual rental payments were linked to inflation. Generally in such cases an entity either does not apply hedge accounting or designates the entire item, or a proportion of it. Not applying hedge accounting or designating the entire item when this is not the intention of the economic hedge gives rise to profit or loss volatility that does not reflect the risk management objective of the hedge.

To address this issue, the IASB introduced a principle in IFRS 9 that permits risk components of non-financial items to be eligible hedged items if they are separately identifiable and reliably measurable. In practice, the ability to meet these criteria will depend on the specific facts and circumstances. Generally it would be easier to demonstrate that a risk component is “separately identifiable and reliably measurable” if it is a price variable referenced in a contract (i.e. a contractually specified risk component) than if the component is not contractually specified but implied. For non-contractually specified risk components it will be necessary to provide sufficient analysis about the market structure of the item from which the risk component is identified in order to demonstrate that the hedged component is eligible.

In brief, under IFRS9, treasurers will be allowed to choose and hedge individual risk factors.

Malcolm Finn pointed out the benefits of hedging the risk components:

These secondary risks are, for example:

Post Source Here: Will IFRS 9 Help Commodity Firms Better Manage Risks?

The Treasurers Wiki explains the benefits of moving from IAS 39 to IFRS 9 for commodity firms:

Under IAS 39, a non-financial item may be designated as a hedged item in its entirety (i.e. all risks), for foreign exchange (FX) risks or for all risks except FX risk. As a result, if an entity economically hedges a non-financial item for a risk component other than FX risk, it is not permitted to designate a hedge for that component in isolation. For example, an entity could not hedge only the inflation component of an operating lease where the contractual rental payments were linked to inflation. Generally in such cases an entity either does not apply hedge accounting or designates the entire item, or a proportion of it. Not applying hedge accounting or designating the entire item when this is not the intention of the economic hedge gives rise to profit or loss volatility that does not reflect the risk management objective of the hedge.

To address this issue, the IASB introduced a principle in IFRS 9 that permits risk components of non-financial items to be eligible hedged items if they are separately identifiable and reliably measurable. In practice, the ability to meet these criteria will depend on the specific facts and circumstances. Generally it would be easier to demonstrate that a risk component is “separately identifiable and reliably measurable” if it is a price variable referenced in a contract (i.e. a contractually specified risk component) than if the component is not contractually specified but implied. For non-contractually specified risk components it will be necessary to provide sufficient analysis about the market structure of the item from which the risk component is identified in order to demonstrate that the hedged component is eligible.

In brief, under IFRS9, treasurers will be allowed to choose and hedge individual risk factors.

Malcolm Finn pointed out the benefits of hedging the risk components:

- Proxy hedging: Where there is correlation and relation to the same type of risk being managed.

- Components: The variability in the commodity price can be a separately identified component of the contract price under IFRS 9. Hedging of components is not permissible under IAS 39.

- Aggregated exposures: The combined commodity price risk and foreign currency risk can be approached efficiently and allows hedge accounting to be achieved more easily. Read more

These secondary risks are, for example:

- Correlation risks: many people believe that there is a strong correlation between FX rate and commodity prices. This is true in most cases. However the relationship can breakdown.

- Similarly, the interrelationship between commodity, interest rate and credit risks is also complex and hard to predict.

- Counter party risks: the hedging counterparty can default, or a loan is refinanced. The embedded contingent option is not often taken into account in the hedging program. (most unsophisticated non-financial corporates are not even aware of the contingent risks)

Post Source Here: Will IFRS 9 Help Commodity Firms Better Manage Risks?

Do Derivative Accounting Rules Make Sense?

As a firm with emphasis on risk management, we always advise our

clients to hedge their portfolios in order to reduce the PnL

volatilities.

However, recently Metlife, the largest insurer in the US, was hit by a $3.2 billion loss in derivatives that were used to hedge the rising interest rates, causing a $2.1 billion loss for the quarter overall.

The loss thus brought up an issue: hedging to reduce the revenue

volatility works only if the hedging and hedged instruments are at the

same level of liquidity and the same accounting rule applies.

Leslie Scism pointed out that the problem is due to the marking to market of the derivative book under GAAP

In the long term, the rise in interest rates bodes well for MetLife. Few American industries are as hurt by low rates as life insurers, which invest huge sums of premium until the money is needed to pay claims. The money is typically invested in higher-quality bonds, so insurers’ profits have been pressured as they put new money to work at the ultralow levels in place since 2008.

MetLife’s results took a hit in the latest period because life insurers must mark their derivatives to market under generally accepted accounting principles. When rates rise, the value of the protection they buy to protect results from low rates falls. Read more

By contrast, Metlife’s liabilities appeared less volatile because the insurer used different assumptions and accounting rules to value their liabilities.

In short, when interest rates rose, the insurer suffered a marked-to-market loss in their derivative hedging book, while the gain in the liability part is not recognized immediately.

The values of both the hedging and hedged assets must be accounted for, but requiring companies to apply different accounting rules to hedging and hedged instruments is too punitive. This can discourage the risk managers to prudently hedge in order to reduce the revenue volatilities.

Maybe a change in accounting rules is needed?

The post Do Derivative Accounting Rules Make Sense? appeared first on Harbourfront Technologies

However, recently Metlife, the largest insurer in the US, was hit by a $3.2 billion loss in derivatives that were used to hedge the rising interest rates, causing a $2.1 billion loss for the quarter overall.

Leslie Scism pointed out that the problem is due to the marking to market of the derivative book under GAAP

In the long term, the rise in interest rates bodes well for MetLife. Few American industries are as hurt by low rates as life insurers, which invest huge sums of premium until the money is needed to pay claims. The money is typically invested in higher-quality bonds, so insurers’ profits have been pressured as they put new money to work at the ultralow levels in place since 2008.

MetLife’s results took a hit in the latest period because life insurers must mark their derivatives to market under generally accepted accounting principles. When rates rise, the value of the protection they buy to protect results from low rates falls. Read more

By contrast, Metlife’s liabilities appeared less volatile because the insurer used different assumptions and accounting rules to value their liabilities.

In short, when interest rates rose, the insurer suffered a marked-to-market loss in their derivative hedging book, while the gain in the liability part is not recognized immediately.

The values of both the hedging and hedged assets must be accounted for, but requiring companies to apply different accounting rules to hedging and hedged instruments is too punitive. This can discourage the risk managers to prudently hedge in order to reduce the revenue volatilities.

Maybe a change in accounting rules is needed?

The post Do Derivative Accounting Rules Make Sense? appeared first on Harbourfront Technologies

Saturday, March 25, 2017

What Is a Contingent Convertible Bond and How to Price It ?

About a year ago, the financial world witnessed another “Lehman

moment”. It was the “near collapse” of Deutsche Bank (DB). The

financial press quickly pointed out the main reason for DB’s plunging

stock price. John Glover wrote

Yield-starved investors bought $102 billion of the contingent convertible bonds, securities created to help troubled banks hang onto cash in times of stress by skipping coupon payments without defaulting and converting the debt to equity or writing it down. Even though neither of those has yet happened, investors are already feeling the pain, as yields on Deutsche Bank AG’s 4.6 billion euros ($5.2 billion) of CoCos have soared and its shares have plummeted.

However, what exactly is a contingent convertible bond ?

According to Wikipedia:

A contingent convertible bond is defined with two elements: the trigger and the conversion rate. While the trigger is the pre-specified event causing the conversion process, the conversion rate is the actual rate at which debt is swapped for equity. The trigger, which can be bank specific, systemic, or dual, has to be defined in a way ensuring automatic and inviolable conversion. A possibility of a dynamic sequence exists—conversion occurs at different pre-specified thresholds of the trigger event. Since the trigger can be subject to accounting or market manipulation, a commonly used measure has been the market’s measure of bank’s solvency. The design of the trigger and the conversion rate are critical in the instrument’s effectiveness

A CoCo bond might appear to be an attractive investment, but from a quantitative point of view, modeling such a contingent conversion feature is far from trivial. As disscussed in this post, pricing even a simple conversion feature would require serious mathematical modeling and programming efforts.

Usually the 20/30 contingent conversion can be modeled somewhat explicitly on the PDE lattice by introducing an extra state variable which tracks whether the condition was satisfied in the previous monitoring quarter. However, the soft call feature is often more material as it is in the interest of the issuer to call the bond as soon as the value equals the call price (plus accrued interest).

Readers who would like to learn more about the mathematical aspects of pricing a contingent convertible bond can start with the following articles:

Approximating the Embedded M Out of N Day Soft-Call Option of a Convertible Bond: An Auxiliary Reversed Binomial Tree Method

Valuing convertible bonds with 20-of-30 soft call provision

Back to the Future: An Approximate Solution for N Out of M Soft-Call Option

Convertible Bond Valuation: 20 Out Of 30 Day Soft-call

The post What Is a Contingent Convertible Bond and How to Price It ? appeared first on Harbourfront Technologies

Yield-starved investors bought $102 billion of the contingent convertible bonds, securities created to help troubled banks hang onto cash in times of stress by skipping coupon payments without defaulting and converting the debt to equity or writing it down. Even though neither of those has yet happened, investors are already feeling the pain, as yields on Deutsche Bank AG’s 4.6 billion euros ($5.2 billion) of CoCos have soared and its shares have plummeted.

However, what exactly is a contingent convertible bond ?

According to Wikipedia:

A contingent convertible bond is defined with two elements: the trigger and the conversion rate. While the trigger is the pre-specified event causing the conversion process, the conversion rate is the actual rate at which debt is swapped for equity. The trigger, which can be bank specific, systemic, or dual, has to be defined in a way ensuring automatic and inviolable conversion. A possibility of a dynamic sequence exists—conversion occurs at different pre-specified thresholds of the trigger event. Since the trigger can be subject to accounting or market manipulation, a commonly used measure has been the market’s measure of bank’s solvency. The design of the trigger and the conversion rate are critical in the instrument’s effectiveness

A CoCo bond might appear to be an attractive investment, but from a quantitative point of view, modeling such a contingent conversion feature is far from trivial. As disscussed in this post, pricing even a simple conversion feature would require serious mathematical modeling and programming efforts.

Usually the 20/30 contingent conversion can be modeled somewhat explicitly on the PDE lattice by introducing an extra state variable which tracks whether the condition was satisfied in the previous monitoring quarter. However, the soft call feature is often more material as it is in the interest of the issuer to call the bond as soon as the value equals the call price (plus accrued interest).

Readers who would like to learn more about the mathematical aspects of pricing a contingent convertible bond can start with the following articles:

Approximating the Embedded M Out of N Day Soft-Call Option of a Convertible Bond: An Auxiliary Reversed Binomial Tree Method

Valuing convertible bonds with 20-of-30 soft call provision

Back to the Future: An Approximate Solution for N Out of M Soft-Call Option

Convertible Bond Valuation: 20 Out Of 30 Day Soft-call

The post What Is a Contingent Convertible Bond and How to Price It ? appeared first on Harbourfront Technologies

Subscribe to:

Posts (Atom)